Voltaic is Australia’s new solar fund.

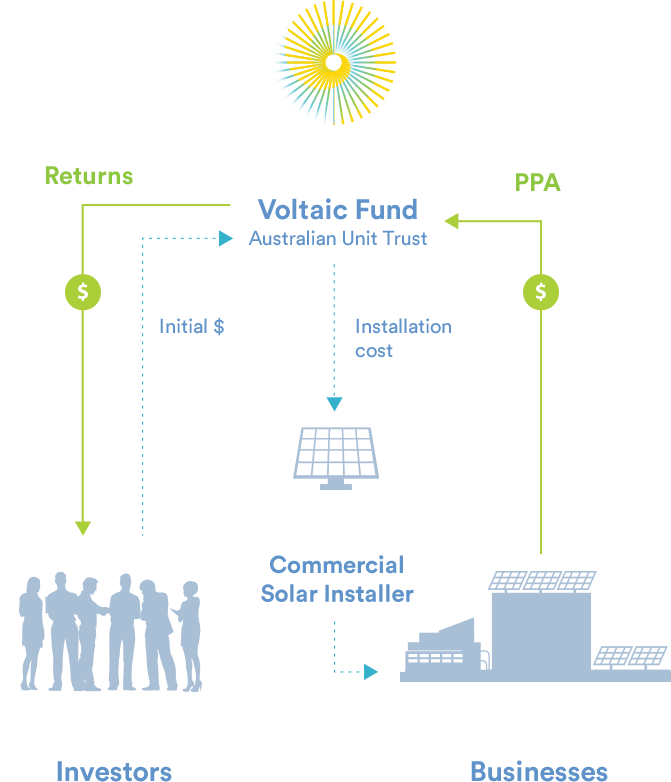

Voltaic invests in a diverse array of commercial solar projects, partnering with commercial solar installers to find, fund and install solar panel systems on the rooftops of businesses looking to save money on their power bills.

The fund pays for the up-front cost of the solar panel systems and enters into contracts with the businesses to sell the generated electricity, at a cheaper rate than otherwise available from the grid. The business save money with cheaper electricty, and we all benefit from an accelerated transition to renewable, green energy.

Please keep scrolling for more information, and learn how you can invest in a solar fund that earns a meaningful return, with impact.

How It Works

Common Questions

We think there are two key reasons for considering an investment in Voltaic.

- Returns – Voltaic should deliver consistent, healthy returns to investors in the form of semi-annual payments

- Impact – an investment in Voltaic will directly fund the installation of solar panels, accelerating Australia’s transition to renewable energy and carbon neutrality.

Businesses often do not want to spend their core capital on electricity bills. It will often be more efficient to deploy capital into running or expanding a business. Businesses may not have the money available to fund the up-front installation cost of solar panels. The PPA structure is a win for all three parties: businesses save on their electricity bills (with greener energy!), commercial installers can offer a funding mechanism to pay for their services and Voltaic’s investors earn steady, regular returns.

4% to 9%

The returns generated by the solar panel projects will be paid out as distributions to investors on a semi-annual basis. Distributions will most likely be treated as income, offset by the depreciation of the solar panels.

The amount of sunshine! More sunshine leads to more electricity produced by the solar projects which leads to more electricity purchased by the businesses and the greater the returns to investors. The Fund will seek investments in geographical areas with reliable sunshine.

Risks include:

• The businesses fail to meet their conditions under the PPA. For example, they might go bankrupt, they might have cash shortfalls and be unable to pay for the electricity.

• Damage to solar panel equipment, including hail and storm damage.

Voltaic will try to reduce risk as much as possible, by conducting due diligence on the businesses and requiring them to insure the solar panels. For a full list of risks, please see the Information Memorandum.

Under the PPA, the solar panels and equipment will be owned by the fund. At the expiration of the PPA, usually between 10 and 20 years, the ownership of the solar panels will transfer to the businesses, either for free or for a nominal payment.

Voltaic is a Fund with pooled assets. Voltaic will invest in a diversified array of solar projects on behalf of investors. Investors, therefore, will not have the ability to pick and choose projects – Voltaic will do that on behalf of all investors. The benefit of this diversification – investors will in effect be invested in multiple projects, rather than a small number. If something were to go wrong with one of the projects, the effect on returns will hopefully be minimal.

Voltaic is open to Wholesale Investors, a legal classification which most people meet by either having greater than $2.5m in net assets (which can include the family home) or income of greater than $250,000 per year. A certificate from an accountant attesting to Wholesale Investor status is required as part of an application.

Voltaic is open to investors on a quarterly basis (that is 1 January, 1 April, 1 July and 1 October). Investors looking to invest should start their application before the application date.

Investors looking to redeem from Voltaic can do so on a quarterly basis. Most of the fund’s assets will be locked up in long term solar projects, so any redemptions are subject to the cash reserves of the fund.

To process a redemption, Voltaic will need to ‘price’ or ‘put a value’ on the fund’s assets. The total “Net Asset Value” of the fund will be calculated and then divided by the total number of units issued to investors, arriving at the fund’s unit price. A simple calculation of the fund’s assets will include the total value of installed solar projects, less the depreciation of the solar panels and equipment over time.

Voltaic charges a 10% performance fee on fund returns. Voltaic does not charge a management fee. The benefit of performance fee only is alignment – Voltaic is only paid when investors are paid.

The fund will pay other fees like accounting, tax, administration and bank fees. The fund will initially be highly sensitive to fees. Voltaic will look to insource as many of these services as possible to save costs. As the fund grows, it will make more economic sense to outsource these services, without materially affecting returns.

Please contact tim@voltaic.fund for more information.

According to legal advice, Voltaic can offer one project to investors as long as it does not raise more than $2m from more than 20 investors in a twelve month period. Voltaic plans to use this exemption to fund the first project. Voltaic has also applied for an Australian Financial Services Licence, which upon receipt, will remove these restrictions.

Yes.

We think there are two key reasons for considering an investment in Voltaic.

- Returns – Voltaic should deliver consistent, healthy returns to investors in the form of semi-annual payments

- Impact – an investment in Voltaic will directly fund the installation of solar panels, accelerating Australia’s transition to renewable energy and carbon neutrality.

Businesses often do not want to spend their core capital on electricity bills. It will often be more efficient to deploy capital into running or expanding a business. Businesses may not have the money available to fund the up-front installation cost of solar panels. The PPA structure is a win for all three parties: businesses save on their electricity bills (with greener energy!), commercial installers can offer a funding mechanism to pay for their services and Voltaic’s investors earn steady, regular returns.

4% to 9%

The returns generated by the solar panel projects will be paid out as distributions to investors on a semi-annual basis. Distributions will most likely be treated as income, offset by the depreciation of the solar panels.

The amount of sunshine! More sunshine leads to more electricity produced by the solar projects which leads to more electricity purchased by the businesses and the greater the returns to investors. The Fund will seek investments in geographical areas with reliable sunshine.

Risks include:

• The businesses fail to meet their conditions under the PPA. For example, they might go bankrupt, they might have cash shortfalls and be unable to pay for the electricity.

• Damage to solar panel equipment, including hail and storm damage.

Voltaic will try to reduce risk as much as possible, by conducting due diligence on the businesses and requiring them to insure the solar panels. For a full list of risks, please see the Information Memorandum.

Under the PPA, the solar panels and equipment will be owned by the fund. At the expiration of the PPA, usually between 10 and 20 years, the ownership of the solar panels will transfer to the businesses, either for free or for a nominal payment.

Voltaic is a Fund with pooled assets. Voltaic will invest in a diversified array of solar projects on behalf of investors. Investors, therefore, will not have the ability to pick and choose projects – Voltaic will do that on behalf of all investors. The benefit of this diversification – investors will in effect be invested in multiple projects, rather than a small number. If something were to go wrong with one of the projects, the effect on returns will hopefully be minimal.

Voltaic is open to Wholesale Investors, a legal classification which most people meet by either having greater than $2.5m in net assets (which can include the family home) or income of greater than $250,000 per year. A certificate from an accountant attesting to Wholesale Investor status is required as part of an application.

Voltaic is open to investors on a quarterly basis (that is 1 January, 1 April, 1 July and 1 October). Investors looking to invest should start their application before the application date.

Investors looking to redeem from Voltaic can do so on a quarterly basis. Most of the fund’s assets will be locked up in long term solar projects, so any redemptions are subject to the cash reserves of the fund.

To process a redemption, Voltaic will need to ‘price’ or ‘put a value’ on the fund’s assets. The total “Net Asset Value” of the fund will be calculated and then divided by the total number of units issued to investors, arriving at the fund’s unit price. A simple calculation of the fund’s assets will include the total value of installed solar projects, less the depreciation of the solar panels and equipment over time.

Voltaic charges a 10% performance fee on fund returns. Voltaic does not charge a management fee. The benefit of performance fee only is alignment – Voltaic is only paid when investors are paid.

The fund will pay other fees like accounting, tax, administration and bank fees. The fund will initially be highly sensitive to fees. Voltaic will look to insource as many of these services as possible to save costs. As the fund grows, it will make more economic sense to outsource these services, without materially affecting returns.

Please contact tim@voltaic.fund for more information.

According to legal advice, Voltaic can offer one project to investors as long as it does not raise more than $2m from more than 20 investors in a twelve month period. Voltaic plans to use this exemption to fund the first project. Voltaic has also applied for an Australian Financial Services Licence, which upon receipt, will remove these restrictions.

Yes.

Why Now?

Energy prices skyrocketed last year - Businesses are looking to save costs.

Solar Panel Installation

continues to fall.

Climate Change is a big problem - we need to act.

About Us

Tim Johnston

Director

Tim Johnston is Founder and Director of Voltaic. Tim has been working in financial services for over a decade, gaining experience in funds management, superannuation, angel investing and alternative investments. Tim is co-founder of Apollo Crypto, Australia’s leading crypto asset fund. Tim has helped grow Apollo from inception in 2018 to managing around $100m in Assets Under Management, citing leading family offices and High Net Worth Individuals as investors.

Tim has previously invested in solar projects. Tim has previously volunteered as a financial modeller in his spare time during Covid lockdowns for SolarShare. Tim has two young girls, aged 4 and 1 and is concerned about the long term implications of Climate Change. Tim hopes his efforts at Voltaic will play a small part in accelerating Australia’s transition to renewable energy and carbon neutrality.

If you are interested in discussing Voltaic, Tim would love to hear from you, either through the contact form below, or email tim@voltaic.fund